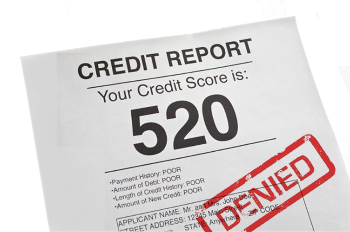

Will Bad Credit Increase My Insurance Premiums?

Your state insurance exam will likely include questions relating to personal credit scores and how they affect insurance premiums. Continuing with our series on insurance exam test tips, in this article we’ll discuss the credit-based insurance score and its effect on premiums.

Your state insurance exam will likely include questions relating to personal credit scores and how they affect insurance premiums. Continuing with our series on insurance exam test tips, in this article we’ll discuss the credit-based insurance score and its effect on premiums.

It’s common knowledge that insurance companies use your credit history to help in setting the rates you pay for homeowners and auto insurance. Insurers can examine information about financial activity from your past— like how much debt you have, and how often you have late or missed bill payments—to produce a credit-based insurance score, or CBI. The CBI is comparable to a FICO credit score, which you may be familiar with, but every insurance company calculates it differently. But it’s only one measure of how your insurance premium is determined. Depending on the state you reside in, and the insurance company, a poor credit history can significantly raise your insurance rates—or have no impact at all.

Explaining the Credit-Based Insurance Score:

The CBI is a number that summarizes your credit history in the eyes of an insurance company. While the precise methodology varies by insurance carrier, following are some things that can affect your score, either positively or negatively:

Positives:

Limited use of credit

Credit accounts in good standing

Lengthy credit history

Few if any late payments

Negatives:

Many past-due accounts

Accounts in collection

Several recent applications for additional credit

Two of the principal factors in shaping your CBI score are the types and amounts of outstanding debt you have, and if you’re late paying your bills. As an example, $150,000 in credit card debt is weighed differently than a $150,000 mortgage.

Why Do Insurance Carriers Use the CBI Score?

Insurance companies use the CBI because there is a correlation between the likelihood of an individual filing a homeowners or auto claim and their insurance score. Basically, your ability to keep your credit score high is a good way for the insurance company to determine how great of a risk you are. And it’s become a very reliable gauge of how large the claims may be. A homeowner who’s able to make their monthly mortgage payments, for example, is also more likely to keep the home in good shape. As a result, insurance companies offer less expensive insurance to people with good credit histories. Conversely, people with poor credit history should expect to pay more for the same insurance, as the losses have been shown to be greater.

Recent studies have shown that drivers with excellent credit scores pay around $1,100 on average while drivers with poor credit scores have an average insurance premium of $2,400, representing an increase of over 50%.

Furthermore, jumping up a single credit tier, such as from good to excellent, can save drivers an extra 15%, on average.

The Differences Between FICO and CBI:

While there are many parallels between the FICO and CBI scores, there are some fundamental differences as well. Generally speaking, while insurance carriers and banks use similar characteristics about your credit history to forecast future credit-related activity, these predictions differ in scope. Insurance carriers are largely concerned about how likely you are to file a claim, while banks want to know if you’re going to pay them back on time. In actuality, this means that a poor FICO score doesn’t necessarily mean you’ll pay more for insurance.

Most larger insurance carriers include a credit check when determining the premium you’ll pay for auto and homeowners insurance. In fact, these days you’d be hard-pressed to find homeowners insurance without submitting to a credit check. The bottom line is that if you do have poor credit, it will likely have a negative impact on the premium you pay for personal insurance.

However, there is some good news: It is rare for an insurance company to flat-out decline to offer an insurance policy based on a poor CBI score alone. Also, as mentioned, your CBI score is only one factor in how insurance companies determine rates. If you don't have the greatest credit history but are good about keeping your home in good shape, rarely filing claims, you may still qualify for a better rate than someone who is considered higher risk. In some states, carriers are obligated to let you know if your credit history has negatively impacted your insurance premium.

Also worth noting, if you’re interested in insurance exam secrets: Massachusetts, Hawaii, and California prevent insurance carriers from using a credit score to determine homeowners insurance rates, so if you live in one of those states a poor credit score will have no impact on the premium you pay.

The Insurance Licensing Exam Virtual Learning Experience is AMAZING! This package includes EVERYTHING you need to pass the insurance licensing exam!

- Interactive Video Course

- Virtual Textbook

- Audio Reinforcement

- Virtual Flash Cards

- TESTivity Mind Maps

- Interactive Crossword Puzzles

- Quizzes and Exam Simulator

The Virtual Learning Experience is AMAZING!

Please take a minute to experience the tour through the menu bar above...You will agree, the LATITUDE Insurance & Securities Test Prep Virtual Learning Experience is the best way to prepare for your FINRA/NASAA and/or state insurance licensing exam.

You may know others who will be taking the Life & Health Insurance Exam, Property & Casualty Insurance Exam or FINRA/NASAA Exam(s).

Please share our site with them.

Thank you for visiting the LATITUDE Insurance & Securities Test Prep online insurance school and good luck with your licensing exam!