What is a Qualified 1035 Exchange?

When a client wants to replace a current insurance product with a different insurance product, an IRC (Internal Revenue Code) Section 1035 exchange may appear like a good solution. In an effort to avoid adverse tax consequences, the individual is able to make the replacement. However, while avoiding tax consequences entirely is a best-case scenario, it’s not the only way that the 1035 exchange works. Depending on the financial products being replaced and several other issues unique to the exchange, the 1035 exchange can be rife with tax consequences that should be avoided.

When a client wants to replace a current insurance product with a different insurance product, an IRC (Internal Revenue Code) Section 1035 exchange may appear like a good solution. In an effort to avoid adverse tax consequences, the individual is able to make the replacement. However, while avoiding tax consequences entirely is a best-case scenario, it’s not the only way that the 1035 exchange works. Depending on the financial products being replaced and several other issues unique to the exchange, the 1035 exchange can be rife with tax consequences that should be avoided.

The product details involved must be understood—including the rules of exchanging them—in order to sidestep tax consequences that may leave someone in a worse situation than before the exchange was made. While your insurance licensing study material may not provide the level of detail presented here, you should still be prepared for a question or two about the exchange on your insurance exam.

The Rules of the 1035 Exchange

Normally, the rules of the 1035 exchange permit an owner of a financial product, such as an annuity contract or life insurance policy, to exchange the products without treating it as a sale. The gain is not documented when the exchange is made, and as such there would be no tax liability.

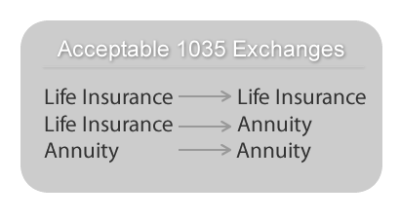

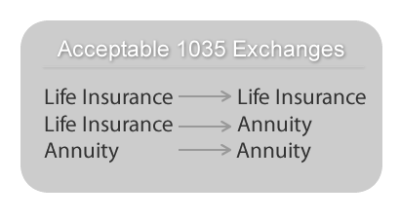

One life policy is permitted to be substituted for another life policy, a long-term care policy, or an annuity contract. Likewise, an annuity is allowed to be replaced with a different annuity contract. However, it cannot be exchanged for a life policy. An endowment policy is permitted to be replaced with a different endowment policy, as long as it doesn’t delay the date when payments are to start, or for a long-term care contract or an annuity. As with annuity contracts, these cannot be exchanged for a life insurance policy.

Also, the policy owner cannot be altered during the exchange. The insured in a life-for-life policy exchange must not change, and the contract owner in the annuity-for-annuity exchange must stay the same. The Internal Revenue Service allows an exception to 1035 treatment relative to a change in insureds. In the case where there are two insured individuals, such as in a survivorship or 2nd-to-die policy, the original policy is replaced with one individual life policy after one insured dies.

Importantly, tax is not imposed on any gain in the first insurance policy exchanged. Even if there isn’t a gain in the first contract, the Section 1035 exchange permits the owner of the contract to carry over the original contract’s basis. In circumstances where the original contract basis is greater than the cash value, the greater basis is preserved.

Pitfalls and Tax Traps

Regardless of the potential for advantageous tax treatment, individuals should be cautious when exercising a Section 1035 exchange. Money moved into a non-qualifying financial product, or amounts used to pay down a loan on the original contract, or cash withdrawn as a result of the exchange, will likely be taxed at the ordinary income tax rate of the individual.

Even if an individual makes a withdrawal from the first contract and then exercises the 1035 exchange, there is the likelihood that the IRS will treat it as one transaction consistent with the “step transaction” doctrine.

Additionally, the guidelines become even more complex when a loan on the first contract is still outstanding. To avoid being taxed on the gain, a loan normally must be carried forward in the exact amount to the new contract. Many insurance companies, however, might not be willing to issue a new life policy if an outstanding loan still exists. In this scenario, the individual may have to pay the loan back entirely before the 1035 exchange can happen.

If someone wants to replace an existing contract with a long-term care insurance contract, they’ll likely only be able to make a partial exchange as single-premium long-term care insurance contracts aren’t available any longer. Even though a partial exchange is allowable under IRS guidelines, many insurance companies are unwilling to allow them due to the administrative costs.

Anyone interested in the exchange should be closely following the guidelines of the Section 1035 rules. The existing contract should be moved to the new insurance company. That new insurance company should then surrender the contract and issue a new contract in its place. An individual shouldn’t accept the cash value of the first contract and then use that to buy a new contract, or risk losing the 1035 exchange advantage.

A Section 1035 exchange provides an important tax-free tool for individuals looking to exchange an existing financial product without any tax liability—if done correctly. The rules provided by the IRS are well defined, however, and must be closely followed in order to avoid any tax-related unpleasantness.

When a client wants to replace a current insurance product with a different insurance product, an IRC (Internal Revenue Code) Section 1035 exchange may appear like a good solution. In an effort to avoid adverse tax consequences, the individual is able to make the replacement. However, while avoiding tax consequences entirely is a best-case scenario, it’s not the only way that the 1035 exchange works. Depending on the financial products being replaced and several other issues unique to the exchange, the 1035 exchange can be rife with tax consequences that should be avoided.

When a client wants to replace a current insurance product with a different insurance product, an IRC (Internal Revenue Code) Section 1035 exchange may appear like a good solution. In an effort to avoid adverse tax consequences, the individual is able to make the replacement. However, while avoiding tax consequences entirely is a best-case scenario, it’s not the only way that the 1035 exchange works. Depending on the financial products being replaced and several other issues unique to the exchange, the 1035 exchange can be rife with tax consequences that should be avoided.

The product details involved must be understood—including the rules of exchanging them—in order to sidestep tax consequences that may leave someone in a worse situation than before the exchange was made. While your insurance licensing study material may not provide the level of detail presented here, you should still be prepared for a question or two about the exchange on your insurance exam.

The Rules of the 1035 Exchange

Normally, the rules of the 1035 exchange permit an owner of a financial product, such as an annuity contract or life insurance policy, to exchange the products without treating it as a sale. The gain is not documented when the exchange is made, and as such there would be no tax liability.

One life policy is permitted to be substituted for another life policy, a long-term care policy, or an annuity contract. Likewise, an annuity is allowed to be replaced with a different annuity contract. However, it cannot be exchanged for a life policy. An endowment policy is permitted to be replaced with a different endowment policy, as long as it doesn’t delay the date when payments are to start, or for a long-term care contract or an annuity. As with annuity contracts, these cannot be exchanged for a life insurance policy.

Also, the policy owner cannot be altered during the exchange. The insured in a life-for-life policy exchange must not change, and the contract owner in the annuity-for-annuity exchange must stay the same. The Internal Revenue Service allows an exception to 1035 treatment relative to a change in insureds. In the case where there are two insured individuals, such as in a survivorship or 2nd-to-die policy, the original policy is replaced with one individual life policy after one insured dies.

Importantly, tax is not imposed on any gain in the first insurance policy exchanged. Even if there isn’t a gain in the first contract, the Section 1035 exchange permits the owner of the contract to carry over the original contract’s basis. In circumstances where the original contract basis is greater than the cash value, the greater basis is preserved.

Pitfalls and Tax Traps

Regardless of the potential for advantageous tax treatment, individuals should be cautious when exercising a Section 1035 exchange. Money moved into a non-qualifying financial product, or amounts used to pay down a loan on the original contract, or cash withdrawn as a result of the exchange, will likely be taxed at the ordinary income tax rate of the individual.

Even if an individual makes a withdrawal from the first contract and then exercises the 1035 exchange, there is the likelihood that the IRS will treat it as one transaction consistent with the “step transaction” doctrine.

Additionally, the guidelines become even more complex when a loan on the first contract is still outstanding. To avoid being taxed on the gain, a loan normally must be carried forward in the exact amount to the new contract. Many insurance companies, however, might not be willing to issue a new life policy if an outstanding loan still exists. In this scenario, the individual may have to pay the loan back entirely before the 1035 exchange can happen.

If someone wants to replace an existing contract with a long-term care insurance contract, they’ll likely only be able to make a partial exchange as single-premium long-term care insurance contracts aren’t available any longer. Even though a partial exchange is allowable under IRS guidelines, many insurance companies are unwilling to allow them due to the administrative costs.

Anyone interested in the exchange should be closely following the guidelines of the Section 1035 rules. The existing contract should be moved to the new insurance company. That new insurance company should then surrender the contract and issue a new contract in its place. An individual shouldn’t accept the cash value of the first contract and then use that to buy a new contract, or risk losing the 1035 exchange advantage.

A Section 1035 exchange provides an important tax-free tool for individuals looking to exchange an existing financial product without any tax liability—if done correctly. The rules provided by the IRS are well defined, however, and must be closely followed in order to avoid any tax-related unpleasantness.

The Insurance Licensing Exam Virtual Learning Experience is AMAZING! This package includes EVERYTHING you need to pass the insurance licensing exam!

- Interactive Video Course

- Virtual Textbook

- Audio Reinforcement

- Virtual Flash Cards

- TESTivity Mind Maps

- Interactive Crossword Puzzles

- Quizzes and Exam Simulator

The Virtual Learning Experience is AMAZING!

Please take a minute to experience the tour through the menu bar above...You will agree, the LATITUDE Insurance & Securities Test Prep Virtual Learning Experience is the best way to prepare for your FINRA/NASAA and/or state insurance licensing exam.

You may know others who will be taking the Life & Health Insurance Exam, Property & Casualty Insurance Exam or FINRA/NASAA Exam(s).

Please share our site with them.

Thank you for visiting the LATITUDE Insurance & Securities Test Prep online insurance school and good luck with your licensing exam!