What's the Difference between a Resident and Nonresident Insurance License?

Insurance laws are governed by state insurance departments, rather than at the federal level. As such, the requirements for producer licensing differ from state to state.

Insurance laws are governed by state insurance departments, rather than at the federal level. As such, the requirements for producer licensing differ from state to state.

In this article, we’ll discuss the differences between a resident and non-resident insurance license, and provide some detail on the requirements.

A state-issued insurance license must be earned to sell insurance in any state. A resident license is simply an insurance producer’s license issued to a resident of that particular state. A non-resident license, on the other hand, is a license issued by a state other than the one the insurance producer resides in, allowing them to sell insurance in that state. The difference is primarily centered on where the producer lives.

Licensing requirements for both resident and non-resident producers differ from state to state. Generally, to get a resident license, you must take an insurance course at a state-approved insurance school. Classes are often held at local business schools or county colleges. The property and casualty insurance course encompasses about 40 hours of training and can be a combination of online and classroom learning. Life, health, and public adjuster pre-licensing requirements are similar though generally require less than 40 hours of class training.

A school test is then given upon completion of the insurance course. Upon passing the school test the student can then take the state licensing insurance exam. The licensing exam is usually computer-based, consisting of 75 to 200 multiple choice questions, depending on the state. There is no essay section.

State exams are proctored and timed, and are given at testing centers nationwide. Centers are often managed by third-party testing firms like Prometric and Pearson Vue. What is a proctored exam? Very simply, it means that someone is present when the test is given. Having someone monitoring the test can prevent the use of outside help like phones and calculators by applicants. Proctors may have to be certified depending on the testing center and state requirements.

After passing the state test, a producer will then be issued a resident producer’s license—after paying required fees and submitting to and passing a background check.

If the producer then wants to sell insurance in a state other than their resident state, they may apply for a non-resident license in that other state. Generally, the applicant will not have to take another insurance course or pass a non-resident state exam. The process of applying usually just involves paying a separate fee (or renewal fee) and keeping up with continuing education requirements in the home state.

In recent years, many states have begun outsourcing the application process for resident and non-resident licenses to the State Insurance Regulatory Connection (Sircon) and the National Insurance Producer Registry (NIPR) via their respective websites. A single login can make the process easier for producers wishing to apply for a non-resident license, and it makes tracking various license renewal dates a much simpler affair. In the past, the licensing process was a cumbersome procedure, requiring, in some cases, insurance company endorsement, notary signatures, and lengthy paper applications.

The National Insurance Producer Registry is a not-for-profit affiliate entity of the National Association of Insurance Commissioners created to aggregate state insurance licensing information into a single portal. Governed by the NAIC Board of Directors, the NIPR was created as a public-private organization with a primary goal of streamlining what once was an archaic and cumbersome producer licensing process.

The NIPR manages a cloud-based database of state licensing regulations and other licensing-related information, known as the Producer Database (PDB). The PDB, in compliance with the Fair Credit Reporting Act, connects most state licensing systems into one easy to use source of insurance producer data. The Producer Database also contains enforcement information by way of the Regulatory Information Retrieval System to deliver a more complete producer summary. Now, all U.S. states, Guam, the U.S. Virgin Islands, the District of Columbia, and Puerto Rico, are all part of the Producer Database.

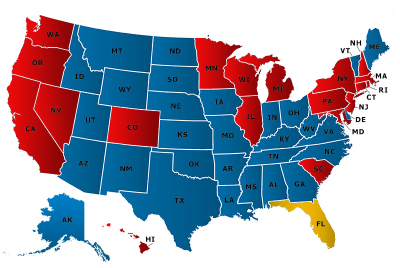

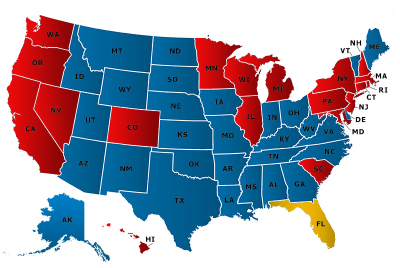

Considering a move? The rules for changing your state of residency vary from state to state. You’ll need to reach out to the states you’re moving to and from for detailed guidelines. Fortunately, the NIPR website provides a clickable map for this purpose. Click on the appropriate state name to get details for making changes and connecting with state insurance departments.

While some states still handle the licensing process on their own, most have gone to the online electronic systems and allow producers to track renewals, print licenses, and keep up with individual state regulations, among other things.

Insurance laws are governed by state insurance departments, rather than at the federal level. As such, the requirements for producer licensing differ from state to state.

Insurance laws are governed by state insurance departments, rather than at the federal level. As such, the requirements for producer licensing differ from state to state.

In this article, we’ll discuss the differences between a resident and non-resident insurance license, and provide some detail on the requirements.

A state-issued insurance license must be earned to sell insurance in any state. A resident license is simply an insurance producer’s license issued to a resident of that particular state. A non-resident license, on the other hand, is a license issued by a state other than the one the insurance producer resides in, allowing them to sell insurance in that state. The difference is primarily centered on where the producer lives.

Licensing requirements for both resident and non-resident producers differ from state to state. Generally, to get a resident license, you must take an insurance course at a state-approved insurance school. Classes are often held at local business schools or county colleges. The property and casualty insurance course encompasses about 40 hours of training and can be a combination of online and classroom learning. Life, health, and public adjuster pre-licensing requirements are similar though generally require less than 40 hours of class training.

A school test is then given upon completion of the insurance course. Upon passing the school test the student can then take the state licensing insurance exam. The licensing exam is usually computer-based, consisting of 75 to 200 multiple choice questions, depending on the state. There is no essay section.

State exams are proctored and timed, and are given at testing centers nationwide. Centers are often managed by third-party testing firms like Prometric and Pearson Vue. What is a proctored exam? Very simply, it means that someone is present when the test is given. Having someone monitoring the test can prevent the use of outside help like phones and calculators by applicants. Proctors may have to be certified depending on the testing center and state requirements.

After passing the state test, a producer will then be issued a resident producer’s license—after paying required fees and submitting to and passing a background check.

If the producer then wants to sell insurance in a state other than their resident state, they may apply for a non-resident license in that other state. Generally, the applicant will not have to take another insurance course or pass a non-resident state exam. The process of applying usually just involves paying a separate fee (or renewal fee) and keeping up with continuing education requirements in the home state.

In recent years, many states have begun outsourcing the application process for resident and non-resident licenses to the State Insurance Regulatory Connection (Sircon) and the National Insurance Producer Registry (NIPR) via their respective websites. A single login can make the process easier for producers wishing to apply for a non-resident license, and it makes tracking various license renewal dates a much simpler affair. In the past, the licensing process was a cumbersome procedure, requiring, in some cases, insurance company endorsement, notary signatures, and lengthy paper applications.

The National Insurance Producer Registry is a not-for-profit affiliate entity of the National Association of Insurance Commissioners created to aggregate state insurance licensing information into a single portal. Governed by the NAIC Board of Directors, the NIPR was created as a public-private organization with a primary goal of streamlining what once was an archaic and cumbersome producer licensing process.

The NIPR manages a cloud-based database of state licensing regulations and other licensing-related information, known as the Producer Database (PDB). The PDB, in compliance with the Fair Credit Reporting Act, connects most state licensing systems into one easy to use source of insurance producer data. The Producer Database also contains enforcement information by way of the Regulatory Information Retrieval System to deliver a more complete producer summary. Now, all U.S. states, Guam, the U.S. Virgin Islands, the District of Columbia, and Puerto Rico, are all part of the Producer Database.

Considering a move? The rules for changing your state of residency vary from state to state. You’ll need to reach out to the states you’re moving to and from for detailed guidelines. Fortunately, the NIPR website provides a clickable map for this purpose. Click on the appropriate state name to get details for making changes and connecting with state insurance departments.

While some states still handle the licensing process on their own, most have gone to the online electronic systems and allow producers to track renewals, print licenses, and keep up with individual state regulations, among other things.

The Insurance Licensing Exam Virtual Learning Experience is AMAZING! This package includes EVERYTHING you need to pass the insurance licensing exam!

- Interactive Video Course

- Virtual Textbook

- Audio Reinforcement

- Virtual Flash Cards

- TESTivity Mind Maps

- Interactive Crossword Puzzles

- Quizzes and Exam Simulator

The Virtual Learning Experience is AMAZING!

Please take a minute to experience the tour through the menu bar above...You will agree, the LATITUDE Insurance & Securities Test Prep Virtual Learning Experience is the best way to prepare for your FINRA/NASAA and/or state insurance licensing exam.

You may know others who will be taking the Life & Health Insurance Exam, Property & Casualty Insurance Exam or FINRA/NASAA Exam(s).

Please share our site with them.

Thank you for visiting the LATITUDE Insurance & Securities Test Prep online insurance school and good luck with your licensing exam!